carried interest tax concession

CGT listed investment companies concession. Or acquired an interest in it when it had a market value of 500 or less.

You deduct your allowable capital losses from your capital gains to reduce your capital gains tax CGT.

. These are the key rates and thresholds that apply in relation to contributions and benefits employment termination payments super guarantee and co-contributions. 200000 as the case may be. House property could not be occupied by the owner due to employment or business carried on at any other place.

Some types of capital loss cannot be deducted and some have restrictions. 200000 as the case may. Deduction for interest on borrowed capital is allowed up to Rs.

Deduction for interest on borrowed capital is allowed up to Rs.

Iasbaba S Mind Map Gaar Changes In Tax Treaties Issue 25th January Mind Map Mindfulness Map

A New Era For Carried Interest In Hong Kong Kpmg China

Pwc Cn Publication More Good News Carried Interest Tax Concession

Hong Kong Carried Interest Tax Implications For Private Equity

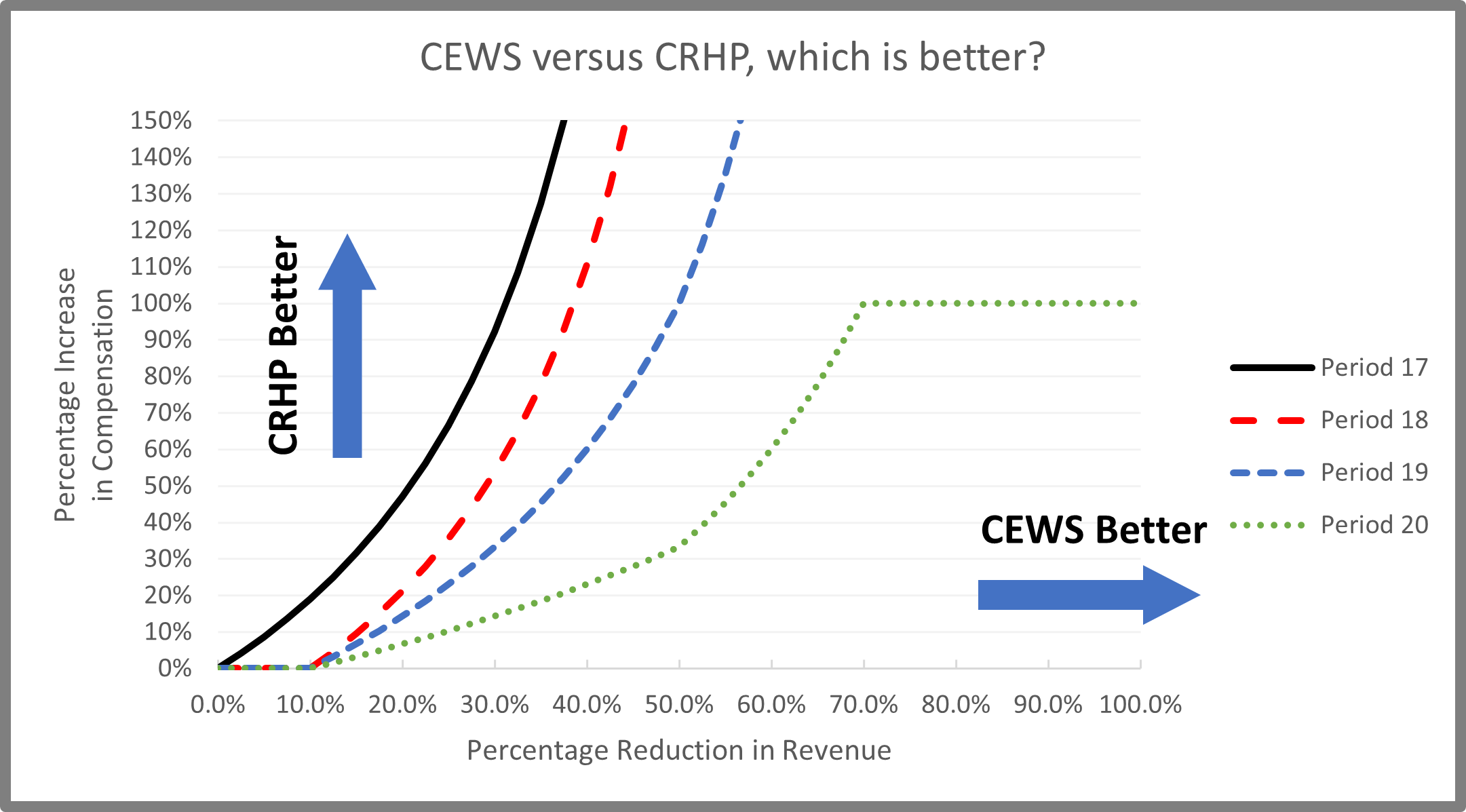

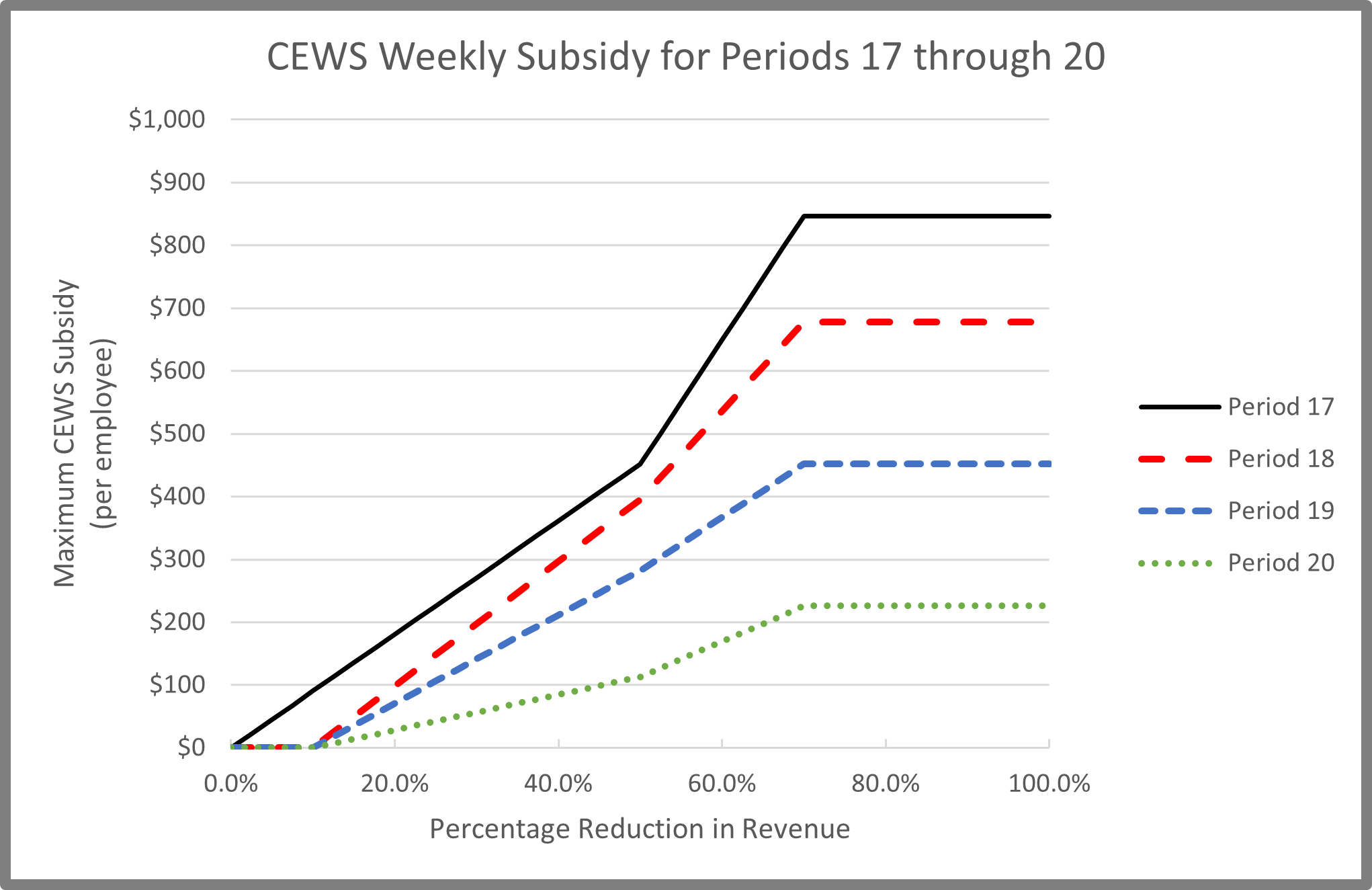

2021 Federal Budget Selected Tax Measures Blakes

Asset Management Tax Update Kpmg China

Dentons Hong Kong Carried Interest Tax Concessions For Private Equity Fund Operators In Hong Kong Enacted As Law Retrospective Effect From April 2020

Americans Working In Canada And Taxes

2021 Federal Budget Selected Tax Measures Blakes

Hong Kong Tax Treatment Of Carried Interest Kpmg United States

Iasbaba S Mind Map Gaar Changes In Tax Treaties Issue 25th January Mind Map Mindfulness Map

Chapter 6 Tax Incentives To Use Or Not To Use In Unleashing Growth And Strengthening Resilience In The Caribbean

Asset Management Tax Update Kpmg China

Pwc Cn Publication New Year Good News Carried Interest Tax Concession